- Details

- Category: Press Releases

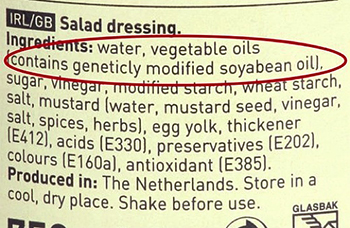

SPRINGFIELD – Earlier this year, State Senator Dave Koehler (D-Peoria) introduced legislation that would require companies to label genetically engineered foods. Knowing that both companies that produce food and health advocacy groups had major concerns about the proposal, he chose to avoid calling a vote so that the issue could be more thoroughly discussed during a series of hearings.

SPRINGFIELD – Earlier this year, State Senator Dave Koehler (D-Peoria) introduced legislation that would require companies to label genetically engineered foods. Knowing that both companies that produce food and health advocacy groups had major concerns about the proposal, he chose to avoid calling a vote so that the issue could be more thoroughly discussed during a series of hearings.

"This legislation isn't about passing a value judgment on genetically engineered food," Koehler said. "It's just about giving consumers information so that they can make their own choices."

Hearings will occur this summer at the following times and locations:

Date: June 20, 2013

Location: Illinois State University, Old Main Room at the Bone Student Center

Time: 10 a.m. to noon

Date: August 7, 2013

Location: Southern Illinois University Carbondale (location to be announced)

Time: noon to 2 p.m.

Third meeting:

Mid-September in Chicago (additional details to be announced)

- Details

- Category: News

The Federal Emergency Management Agency and its Illinois counterpart have opened Disaster Recovery Centers today in several areas affected by recent flooding.

The Federal Emergency Management Agency and its Illinois counterpart have opened Disaster Recovery Centers today in several areas affected by recent flooding.

Services available at the DRCs include help applying for disaster assistance and other relief programs from agencies such as the U.S. Small Business Administration, state and local agencies, and volunteer organizations. To be eligible for federal assistance, residents must apply with FEMA even if they already have given information to other agencies.

For 46th District residents, the Disaster Recovery Center is located at the Fulton County Health Department, 700 E. Oak St., Canton, IL 61520. The center is open from 9 a.m. to 7 p.m. every day.

- Details

- Category: Press Releases

SPRINGFIELD –After years of slashed budgets and bureaucratic delays, Illinois is finally putting Wildlife Prairie Park back in local hands.

SPRINGFIELD –After years of slashed budgets and bureaucratic delays, Illinois is finally putting Wildlife Prairie Park back in local hands.

"It's taken a surprisingly long time to get here," said State Senator Dave Koehler, "but we've finally managed to hand Wildlife Prairie Park over to a Peoria-area non-profit that will make sure it stays open for family-friendly education and entertainment."

The 2,000 acre park, which allows the people of Illinois to see the state's indigenous wildlife in a natural setting, has survived the state's budget cuts largely due to the efforts of Friends of Wildlife Prairie State Park, a not-for-profit organization dedicated to the park's mission of promoting conservation, education and recreation. The Friends group assumed legal control of the park today.

Koehler, a Peoria Democrat, has worked with local elected officials from both parties to get the state to turn over the park to the Friends group for the past two years. After making it one of his top priorities this year, Koehler managed to push the law turning over the park all the way to the governor's desk in time for the park's summer season.

"I want to be able to share the park with my grandchildren," Koehler said. "People here in Peoria have demonstrated that they are willing to put in the time, money and hard work we need to keep the park open. With year after year of budget cuts, the state just couldn't make that commitment anymore."

Though the state is transferring ownership of the park to the Friends group, the legal agreement requires the group to keep the park open to the public and to maintain its current mission.

The law requiring the state to relinquish the park takes effect immediately.

- Details

- Category: News

Continuing his long-standing effort to protect and promote the environment, State Senator Dave Koehler has queued up two pieces of green legislation for a Senate vote later this month. One makes it easier to compost on small-scale farms. The other will make it possible for non-profits to run biogas facilities.

Continuing his long-standing effort to protect and promote the environment, State Senator Dave Koehler has queued up two pieces of green legislation for a Senate vote later this month. One makes it easier to compost on small-scale farms. The other will make it possible for non-profits to run biogas facilities.

The composting plan will allow small farms to accept more biodegradable materials from other locations. Koehler is co-sponsoring a related measure that makes it easier to compost in urban farms and community gardens.

"The classic environmentalist credo is 'reduce, reuse, recycle,'" Koehler said. "Composting is a good example of reducing our reliance on chemical fertilizers by reusing plant and food waste that would otherwise go into landfills. More composting is a good thing."

Composting is highly supported by members of the local food movement because it allows small-scale farms and urban rooftop and community gardens to feed their crops. It also allows organic farmers to fertilize naturally.

Koehler's other effort – allowing non-profit companies to operate biogas facilities – is particularly relevant as biogas facilities open up across Illinois, from downstate Danville to urban Chicago. Biogas is methane created when organic materials – such as plant matter or human or animal waste material - decompose. The gas is then often burned to produce electricity.

"If a non-profit group can raise the funds to start a biogas facility, government regulation shouldn't get in the way," Koehler said. "Together with wind, hydro and solar power, biogas is helping us create clean, non-fossil-fuel energy."

More Articles …

Page 114 of 123